VANCOUVER, BRITISH COLUMBIA, March 1, 2018 - Lupaka Gold Corp. ("Lupaka Gold" or the “Company") (TSX-V: LPK, FRA: LQP) today announced the results of the Preliminary Economic Assessment (“PEA”) prepared pursuant to National Instrument 43-101 (NI 43-101) on the Company’s 100% owned Invicta Gold Development Project (“Invicta Project” or “Invicta”), located 120km north of Lima, Peru. All values are in US dollars unless otherwise indicated.

Invicta Project PEA Highlights:

- Updated Mineral Resource Statement of 3.0 million tonnes of Indicated Mineral Resources at 5.78 grams per tonne (“g/t”) gold equivalent ounces (“Au-Eq.”) using a 3.0 g/t Au-Eq. cut-off, and 0.6 million tonnes of Inferred Mineral Resources at 5.29 g/t Au-Eq.

- Initial 6-year mine plan (underground) designed on a portion of the mineral resource utilizing the existing infrastructure and minimizing capital start-up costs

- Sub-level open stope mining producing ~ 670,000 minable tonnes at 8.6 g/t Au-Eq.* with production of ~ 185,000 Au-Eq. oz (within initial 6-year mine plan)

- Average annual pre-tax cash flows of $10.2 million, average annual after-tax cash flow of $8.2 million

- Annual production of 33,700 Au-Eq. oz, during steady state

- Annual payable metal of 26,700 Au-Eq. oz, during steady state

- All-in Sustaining Costs of $575 Au-Eq. oz over initial 6-year mine life, average annual pre-tax operating profit of $12.3 million

- Pre-tax 5% NPV of $53.6 million

- After tax 5% NPV of $43.4 million

- Low capital investment: $4.3 million in pre-production capital with a payback of less than one year

- Strong upside potential for additional mineral resource growth

- Located in a premier South American mining jurisdiction, operating permits and community agreement in place

* Au-Eq. calculations in the PEA are based on $1300 Au, $16.75 Ag, $3.00 Cu, $1.25 Zn, and $1.05 Pb

“We are highly encouraged by the robust economics contained in the PEA, which considers only a small portion of the total resource adjacent to Invicta’s existing infrastructure. A combination of the high-grade 6-year initial mine plan and the relatively low capital start-up costs results in immediate meaningful cash flows. The PEA demonstrates the viability of the project and provides us with confidence to reinvest cash flow into the project, in order to realize its full potential. As we initiate the operational plan outlined in the PEA, our next steps will include increasing the resource confidence level, expanding the resource base, and evaluating opportunities for the Company to acquire or develop its own processing plant.”

Will Ansley, President and CEO of Lupaka

Project Background

Lupaka’s Invicta Gold Project is a polymetallic development project located approximately 120 kilometres north of Lima, Peru. A Preliminary Economic Assessment (PEA) has been undertaken on the project to evaluate the economic viability of the underground extraction of Indicated and Inferred Mineral Resources from the Atenea Vein close to the existing 3,400 Level adit (up to 130 metres above the 3400 Level) utilizing a sub-level long hole open stoping mining method supported by initial toll treatment processing options.

The PEA considers only part of the reported Mineral Resource (the Atenea Vein close to existing infrastructure) with the objective of generating a positive cash flow from a low-cost operation while simultaneously re-investing in and further evaluating the deposit to potentially expand production in future.

The PEA has been undertaken by a multi-disciplinary team of independent consultants from SRK Consulting (Peru) Inc., SRK Consulting (Canada) Inc. and Transmin Metallurgical Consultants in collaboration with Lupaka.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

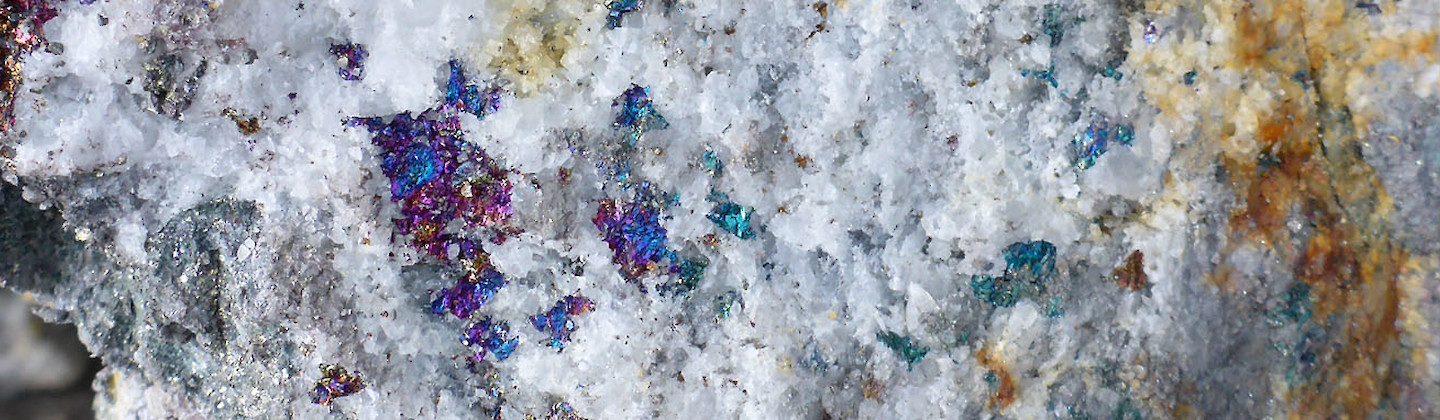

Geology / Mineral Resources

The generation of the geology and mineral resource model was undertaken by SRK Consulting (U.S.), Inc. in 2012 considering 112 core boreholes drilled by previous operator Pangea Peru S.A. during the period of 1997 to 1998, 53 core boreholes drilled by Invicta Mining Corporation S.A.C.(Invicta) between 2006 and 2008 and 10 underground channels between 2007 and 2008. Mesothermal to Epithermal gold mineralization has been modeled within seven quartz-hosted wireframes at the Invicta Project. The mineral resource model is a geostatistically-based block model constrained by geological wireframes, documented in a technical report filed by previous owner, Andean American Gold Corporation, in April 2012. No additional exploration data has been acquired on the project since the generation of the model in 2012.

The Mineral Resource Statement which forms the basis of the PEA was reviewed by SRK Consulting (Peru) S.A., and was found to fairly reflect the informing data and the geological interpretation at the time of modeling. The Mineral Resource Statement has been re-stated to reflect current metal prices and costs. The Mineral Resource Statement for the Invicta Project is tabulated in Table 1, reported to a cut-off grade of 3.0 g/t Au-Eq. Cut-off grades are based on a price of US$1,250 per ounce of gold, US$17.00 per ounce of silver, US$3.00 per pound of copper, US$1.05 per pound of lead and US$1.20 per pound of zinc. The equivalent gold calculation assumes mill recoveries of 85 percent for gold, 80 percent for silver, 82 percent for copper and lead and 77 percent for zinc.

This Mineral Resource Statement differs from that previously reported in 2012, primarily due to the reduction of metallurgical recovery assumptions, an increase in gold equivalent cut-off grade from 1.3 g/t to 3.0 g/t, and revisions to metal price assumptions.

Table 1 : Mineral Resource Statement*, Invicta Project, Huaura Province, Peru, SRK Consulting (Peru) S.A., February 28, 2018

| Zone | Category | Metal Grade | Contained Metal (000's) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tonnes (000's) | AuEq (g/t) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn ( %) | AuEq (oz) | Au (oz) | Ag (oz) | Cu (lb) | Pb (lb) | Zn (lb) | ||

| Atenea - All Zones | Mea | - | - | - | - | - | - | |||||||

| Ind | 2,516 | 6.03 | 4.19 | 26.68 | 0.64 | 0.39 | 0.47 | 488 | 339 | 2,158 | 35,513 | 21,429 | 25,988 | |

| Mea+Ind | 2,516 | 6.03 | 4.19 | 26.68 | 0.64 | 0.39 | 0.47 | 488 | 298 | 1,999 | 33,051 | 20,139 | 24,467 | |

| Inferred | 535 | 5.40 | 5.09 | 4.77 | 0.06 | 0.11 | 0.16 | 93 | 88 | 82 | 673 | 1,315 | 1,878 | |

| Dany | Mea | - | - | - | - | - | - | |||||||

| Ind | 55 | 4.03 | 1.36 | 31.57 | 1.39 | 0.05 | 0.06 | 7 | 2 | 56 | 1,683 | 59 | 77 | |

| Mea+Ind | 55 | 4.03 | 1.36 | 31.57 | 1.39 | 0.05 | 0.06 | 7 | 2 | 56 | 1,683 | 59 | 77 | |

| Inferred | 4 | 4.50 | 1.48 | 38.57 | 1.56 | 0.03 | 0.06 | 1 | 0 | 5 | 132 | 3 | 5 | |

| Pucamina | Mea | - | - | - | - | - | - | |||||||

| Ind | 229 | 4.63 | 4.02 | 10.27 | 0.09 | 0.31 | 0.30 | 34 | 30 | 76 | 443 | 1,582 | 1,495 | |

| Mea+Ind | 229 | 4.63 | 4.02 | 10.27 | 0.09 | 0.31 | 0.30 | 34 | 30 | 76 | 443 | 1,582 | 1,495 | |

| Inferred | 21 | 3.76 | 3.37 | 5.32 | 0.16 | 0.04 | 0.08 | 3 | 2 | 4 | 75 | 18 | 35 | |

| Ydalias - All Zones (12) | Mea | - | - | - | - | - | - | |||||||

| Ind | 9 | 7.60 | 4.38 | 39.21 | 1.50 | 0.37 | 0.23 | 2 | 1 | 11 | 294 | 71 | 45 | |

| Mea+Ind | 9 | 7.60 | 4.38 | 39.21 | 1.50 | 0.37 | 0.23 | 2 | 1 | 11 | 294 | 71 | 45 | |

| Inferred | 0 | 8.00 | 3.91 | 51.60 | 2.00 | 0.27 | 0.18 | 0 | 0 | 0 | 13 | 2 | 1 | |

| Zone 4 | Mea | - | - | - | - | - | - | |||||||

| Ind | 190 | 4.38 | 3.38 | 14.93 | 0.43 | 0.13 | 0.09 | 27 | 21 | 91 | 1,805 | 536 | 371 | |

| Mea+Ind | 190 | 4.38 | 3.38 | 14.93 | 0.43 | 0.13 | 0.09 | 27 | 21 | 91 | 1,805 | 536 | 371 | |

| Inferred | 16 | 3.92 | 1.72 | 20.79 | 1.17 | 0.08 | 0.05 | 2 | 1 | 11 | 417 | 28 | 20 | |

| Total All Zones | Mea | - | - | - | - | - | - | |||||||

| Ind | 2,999 | 5.78 | 4.07 | 24.81 | 0.60 | 0.36 | 0.42 | 558 | 392 | 2,392 | 39,739 | 23,678 | 27,977 | |

| Mea+Ind | 2,999 | 5.78 | 4.07 | 24.81 | 0.60 | 0.36 | 0.42 | 558 | 392 | 2,392 | 39,739 | 23,678 | 27,977 | |

| Inferred | 577 | 5.29 | 4.91 | 5.49 | 0.10 | 0.11 | 0.15 | 98 | 91 | 102 | 1,311 | 1,365 | 1,939 | |

* Mineral resources are not mineral reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

Grade Sensitivity Analysis

The Mineral Resources of the Invicta Project are sensitive to the selection of the reporting cut-off grade. To illustrate this sensitivity, the global block model quantities and grades are presented in Table 2.

Table 2 : Global Block Model Quantities and Grade Estimates*, Invicta Project at Various Cut-off Grades

| Cut-off Grade (g/t Au-Eq.) | Indicated | Inferred | ||||

|---|---|---|---|---|---|---|

| Quantity (000't) | Grade AuEq (g/t) | AuEq Metal (000' oz) | Quantity (000't) | Grade AuEq (g/t) | AuEq Metal (000' oz) | |

| 2.5 | 3,796 | 5.14 | 628 | 928 | 4.37 | 130 |

| 3.0 | 2,999 | 5.78 | 558 | 577 | 5.29 | 98 |

| 3.5 | 2,451 | 6.35 | 501 | 526 | 5.49 | 93 |

| 4.0 | 2,024 | 6.90 | 449 | 473 | 5.69 | 86 |

| 4.5 | 1,674 | 7.46 | 402 | 366 | 6.09 | 72 |

| 5.0 | 1,405 | 7.98 | 361 | 179 | 7.44 | 43 |

Mining and Processing

The PEA operating plan is based on the underground extraction of Indicated and Inferred Mineral Resources from the Atenea vein close to the existing 3,400 Level adit (up to 130 metres above the 3400 Level) utilizing a sub-level long hole open stoping mining method, with waste rock as backfill where possible.

Utilizing in part existing historic mine development, the main extraction level will be on the 3400 Level with surface access via the adit. A secondary ramp from surface will develop drilling horizon sub-levels spaced 15m to 30m. Long hole drilling and blasting techniques will be used. The blasted material will be mucked from the extraction level by 4 yd3 LHD’s where it will then be dumped directly into 30 tonne haulage trucks. The trucks will then transport the material from the adit to an off-site mill processing facility.

The 130m high, 40 m long, 4m to 12m wide stopes will be separated by rib pillars and filled with available waste rock from mine development waste.

Production as outlined by the PEA considers an average peak steady state rate of approximately 350 tonnes per day. The initial 6-year mine life commencing in 2018 is expected to produce a total of 669,813 tonnes of mineralized material inclusive of a 11% external dilution with an 83% mine recovery (Table 3).

Table 3 : Summary of PEA Production Schedule and Grades

| Total | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

|---|---|---|---|---|---|---|---|---|

| Annual Mine Production | tonnes | 669,813 | 89,905 | 124,510 | 124,949 | 124,368 | 123,790 | 82,291 |

| Average Daily Production | tpd | 319 | 257 | 356 | 357 | 355 | 354 | 235 |

| Au-Eq. Grade | g/t | 8.58 | 8.55 | 8.47 | 9.20 | 8.62 | 7.45 | 9.45 |

| Au-Eq. Produced Ounces | Oz. | 184,708 | 24,723 | 33,896 | 36,963 | 34,484 | 29,644 | 24,997 |

| Au-Eq. Payable Ounces | Oz | 145,765 | 19,487 | 26,822 | 29,057 | 27,315 | 23,513 | 19,572 |

Results of metallurgical tests indicate that conventional flotation technology can be used to treat the mineral resources from Invicta. The flowsheet includes crushing, a coarse primary grind, bulk lead, copper, gold and silver flotation, flotation of a Zn concentrate, bulk concentrate regrinding, and selective Cu/Pb flotation. Table 4 illustrates the assumed concentrate recoveries and Table 5 shows the assumed concentrate grades.

Table 4 : Concentrate Recoveries

| Recovery | |||||

|---|---|---|---|---|---|

| Cu conc | Pb conc | Zn conc | Total | ||

| Gold | % | 77.3 | 10.6 | 87.9 | |

| Silver | % | 45.5 | 34.1 | 79.6 | |

| Copper | % | 84.1 | 84.1 | ||

| Lead | % | 82.6 | 82.6 | ||

| Zinc | % | 14.3 | 68.4 | 82.7 | |

Table 5 : Concentrate Grades

| Concentrate | ||||

|---|---|---|---|---|

| Cu | Pb | Zn | ||

| Copper | % | 30.1 | 5.7 | 2.8 |

| Lead | % | 5.2 | 48.5 | 1.0 |

| Zinc | % | 1.9 | 5.5 | 54.9 |

Cash Flow Analysis

Over the initial 6-year operating plan outlined in the PEA, the pre-tax NPV using a 5% discount rate is $53.6 million (Table 6) and the post-tax NPV using a 5% discount rate is $43.4 million (Table 7).

Table 6 : Pre-tax Discounted NPV - Metal Price Sensitivities

| Pre-Tax NPV ($ M) | -10% | Base Case | +10% | |

|---|---|---|---|---|

| Discount Rates | 0% | $43.6 | $60.9 | $78.2 |

| Base Case 5% | $38.2 | $53.6 | $69.0 | |

| 8% | $35.5 | $50.0 | $64.4 | |

| Payback Years | <1 | <1 | <1 | |

Table 7 : After-tax Discounted NPV - Metal Price Sensitivities

| After-Tax NPV ($ M) | -10% | Base Case | +10% | |

|---|---|---|---|---|

| Discount Rates | 0% | $36.2 | $49.0 | $61.4 |

| Base Case 5% | $31.9 | $43.4 | $54.4 | |

| 8% | $29.8 | $40.6 | $50.9 | |

| Payback Years | <1 | <1 | <1 | |

Metal price assumptions for the base case are $1,300 oz Au, $16.75 oz Ag, $3/lb Cu, $1.25/lb Zn, $1.05 Pb.

The revenue contributions of each metal are tabulated in Table 8.

Table 8 : Revenue Contribution by Commodity and Percentage

| Total Project | % | |

|---|---|---|

| Gold | $125.0 | 66 |

| Silver | $11.3 | 6 |

| Total Precious Metal | $136.3 | 72 |

| Copper | $31.9 | 17 |

| Zinc | $12.1 | 6 |

| Lead | $9.2 | 5 |

| Total | $189.5 | 100 |

Capital Cost Estimates

The PEA has been designed to minimize initial capital outflows by utilizing the existing underground infrastructure to access mineralization in proximity to the 3400 Level adit, rehabilitate and utilize the existing 65-person camp, and truck mineralized material to toll milling facilities thereby avoiding the requirement to build a plant on site. Initial pre-production capital expenditures are estimated at $4.3 million (Table 9). The projects pre-production capital consists of rehabilitation to existing underground and surface infrastructure, installation of underground services, preparation and development of underground infrastructure including a new adit at the 3,430 Level, associated cross-cut and connection to the 3,400 Level which completes the ventilation circuit and secondary egress, as well as significant improvements to the projects access road.

Excluded from capital expenditures is $1 million which was spent in 2017 to buy-back and extinguish the 1% royalty over Invicta owned by Franco Nevada. No additional royalties remain on the property.

Table 9 : Initial Pre-Production Capital and Sustaining Capital Breakdown

| Initial Capital (M) | Sustaining Capital (M) | Total Capital (M) | |

|---|---|---|---|

| Project infrastructure | $1.8 | $2.3 | $4.1 |

| Development | $2.5 | $6.1 | $8.6 |

| Total | $4.3 | $8.4 | $12.7 |

Lupaka have identified multiple toll treatment plants that would be capable of treating the mineral resources within the PEA mine plan with minor modifications. The mineral resources will be trucked to one of these facilities where separate copper, lead and zinc concentrates would be produced by the toll facility, supervised by Lupaka staff. All capital and operating costs associated with the ROM treatment and tailings disposal would be the responsibility of the toll treatment facility, under a cost per tonne agreement.

Preliminary review of marketing terms for the Invicta Project’s saleable concentrates has occurred and discussions with traders are ongoing. Concentrates will be trucked from the selected toll treatment facility to the port of Callao for sale or export.

Operating Cost Estimates

The PEA estimates that the Invicta Project will produce approximately 187,000 Au-Eq. ounces over the initial 6-year mine plan. Mining and trucking costs are estimated based on third party contractor rates, processing charges are estimated based on discussions held with local toll processing facilities. General and administration is based on internal estimates, local labor rates, and from experience running operating the Invicta camp facility. Estimates project operating costs are tabulated in Table 10. Average cash costs and all-in costs for the project are tabulated in Table 11.

The Invicta Project does not have any royalties.

Table 10 : Operating Unit Costs

| Unit Operating Costs | ||

|---|---|---|

| Underground Mining and Development | $/tonne mined | $37.30 |

| Trucking and Haulage | $/tonne mined | $50.20 |

| Processing | $/tonne mined | $37.53 |

| General & Administration | $/tonne mined | $12.62 |

| Total | $/tonne mined | $137.6 |

Table 11 : Cash Costs

| Unit Cash Costs | ||

|---|---|---|

| Operating Cost | Au-Eq oz | $508 |

| All-in Sustaining Cost | Au-Eq oz | $575 |

Qualified Persons

This news release has been reviewed and approved by the following “Qualified Persons”, as defined by NI-43-101:

- Glen Cole, PGeo, of SRK Consulting (Canada) Inc., an “Independent Qualified Person” (Geology and Mineral Resources)

- Camila Passos, PGeo, SRK Consulting (Peru) S.A., an “Independent Qualified Person” (Mineral Resources)

- Gary Poxleitner, PEng, of SRK Consulting (Canada) Inc., an “Independent Qualified Person” (Mining and Financial Analyses)

- Adam Johnston, MAusIMM, Chief Metallurgist, Transmin Metallurgical Consultants, an “Independent Qualified Person” (Mineral Processing)

Technical Report

Further information about the PEA and the resource estimate referenced in this news release, including data verification, key assumptions, parameters, risks and other factors, will be provided in a technical report prepared following Canadian Securities Administrators’ National Instrument (NI) 43-101 and Form 43-101F1 guidelines for the Invicta Project that the Company will file on SEDAR (www.sedar.com) within 45 days of this Press Release.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release.

About Lupaka Gold

Lupaka is an active Canadian-based company focused on creating shareholder value through discoveries and strategic development of its assets in some of the most prolific mining regions of Peru.

Invicta Gold Development Project - 100% owned, the Company’s flagship project is an advanced stage gold-copper polymetallic underground deposit located approximately 120 kilometres north of Lima. Over $12 million of capital has been spent by previous owners on development and infrastructure at Invicta, and management expects to commence potential production in the second half of 2018 by using third-party mining contractors and utilizing the existing adit and workings. The Invicta project is fully permitted and community agreements are in place.

The potential underground operation will be focused on underground extraction of Indicated Mineral Resources and Inferred Mineral Resources from the Atenea vein within close proximity to the existing 3400 Level adit (up to 130 metres above the 3400 Level).

Invicta’s approved EIA allows for mine production of up to 1,000 tpd, although the current mining plan is targeting 350 tpd.

Cautionary Note Regarding the Invicta Production Decision

The decision to commence potential production at the Invicta Gold Project and the Company’s plans for a mining operation as referenced herein (the “Production Decision and Plans”) are based on economic models prepared by the Company in conjunction with management’s knowledge of the property and the existing estimate of Indicated and Inferred Mineral Resources on the property, supplemented by the 2018 PEA. The Production Decision and Plans were not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Plans, in particular the risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations are more difficult or more expensive than expected, the risk that the Company will not be able to transport or sell the mineralized material it produces to local custom toll mills on the terms it expects, or at all; production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis according to and in accordance with NI 43-101.

Josnitoro Gold Project - the Company holds an option to earn a 65% interest on this project from Hochschild Mining PLC. The project is located approximately 800 kilometres by road southeast of Lima in the Department of Apurimac, southern Peru, within the Andahuaylas-Yaury Belt, in which the Las Bambas mine (MMG Limited) and the Constancia mine (HudBay Minerals) are located. Historical work on the disseminated gold zones includes over 170 shallow drill holes and extensive surface trenching, as well as artisanal mining.

About SRK Consulting Canada Inc.

SRK Consulting Canada Inc. form part of the SRK Consulting Group which is an independent, international consulting company that provides focused advice and solutions to clients, mainly from earth and water resource industries. Formed in 1974, SRK now employs more than 1,400 professionals in over 40 offices on 6 continents. Among SRK's 1,500 clients are most of the world's major- and medium-sized metal and industrial mineral mining houses, exploration companies, banks, petroleum exploration companies, construction firms and government departments.

About Transmin Metallurgical Consultants

Transmin is an independent consulting firm that provides metallurgical expertise and services to mining projects and operations throughout South America.

FOR FURTHER INFORMATION PLEASE CONTACT:

Will Ansley, President & C.E.O.

wansley@lupakagold.com

Tel: (416) 862-5257

or visit the Company’s profile at www.sedar.com or its website at www.lupakagold.com

Qualified Person

The technical information in this document has been reviewed and approved by Julio Castañeda Mondragon, MAIG, the President of Lupaka Gold Peru S.A.C., a Peruvian subsidiary of the Company, and a Qualified Person as defined by National Instrument 43-101. Mr. Castañeda has verified the scientific and technical information, including sampling, analytical and test data underlying the information or opinions contained in this news release.

Cautionary Statements Regarding Forward Looking Information

All statements, trend analysis and other information contained in this press release relative to anticipated future events or results constitute forward-looking statements. All statements, other than statements of historical fact, included herein, including, without limitation, statements relating to improvements in the road to the Invicta Project and its anticipated benefits and the timing of completion of the improvements, the timing of the commencement of potential production from the Invicta Project and the generation of cash therefrom, the anticipated methods of production, the receipt of and anticipated use of proceeds of the PLI Financing, the Company’s plans and intentions for Invicta, mineral resource estimates, are forward-looking statements. Forward-looking statements are based on assumptions, estimates and opinions of management at the date the statements are made that the Company believes are reasonable, including: that the repayment of the PLI Financing is consummated on the anticipated terms, that the supplies, equipment, personnel, permits, and local community approvals required to conduct the Company's planned pre-production and development activities will be available on reasonable terms, that the Company will be able to comply with the delivery and other obligations in the PLI Financing Agreement, that results of exploration activities will be consistent with management's expectations and that the Company will not experience any material accident, labour dispute, or failure of equipment and with respect to the planned mining operations at Invicta; that pre-production mine development can be completed in the time and for the cost projected; that the Company will be able to obtain funding for planned production expenses; that mineralization at Invicta will be of the grades and in the locations expected; that the Company will be able to extract and transport mineralized rock efficiently and sell the mineralized rock at the prices and in the manner and quantities expected; that permits will be received on the terms and timeline expected and that other regulatory or permitting issues will not arise; that mining methods can be employed in the manner and at the costs expected and that such methods yield the results the Company expects them to. However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks, uncertainties and other factors include, among others: all of the risks described in this news release; failure of the PLI Financing to complete on the proposed terms or at all, including due to the Company’s inability to complete the conditions precedent, the risk that actual results of exploration and development activities will be different than anticipated; that the Company will not be able to comply with the delivery or other obligations in the PLI Financing Agreement and the risk that PLI will enforce its security over the Company’s assets, including its mineral properties; that cost of labour, equipment or materials will increase more than expected; that the future price of gold will decline; that the Canadian dollar will strengthen against the U.S. dollar; that mineral resources are not as estimated; unexpected variations in mineral resources, grade or recovery rates; risks related to shipping mineralized rock; the risk that local mills cannot or will not buy or process mineralized rock from the planned production for the prices expected or at all; risk of accidents, labour disputes and other risks generally associated with mineral exploration; unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing; and all of the risks generally associated with the development of mining facilities and the operation of a producing mine, as well as the risks described in the Company’s annual information form, which is available on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof. Lupaka Gold does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.