NOT FOR DISTRUBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BRITISH COLUMBIA, September 28, 2015 -- Lupaka Gold Corp ("Lupaka Gold" or the "Company") (TSXV:LPK, BVL:LPK, FRA:LQP) is pleased to announce that it has closed the second and final tranche of a non-brokered private placement ("Placement") previously announced on August 21, 2015.

Pursuant to the closing of the second and final tranche on September 25, 2015 of the Placement, the Company issued 2,146,430 units (the "Units") at a price of $0.07 for gross proceeds of $150,250.15. Each Unit consists of one common share and one transferable common share purchase warrant (each, a "Warrant"). Each Warrant entitles the holder to purchase one additional common share, exercisable at $0.15 for a period of thirty six months from closing.

On August 24, 2015, the Company announced the closing of the first tranche of the Placement for total gross proceeds of $452,260.00 and issued 6,460,854 Units. With the completion of the second and final tranche, the Company has issued an aggregate of 8,607,284 Units for total gross proceeds of $602,510.15.

At any time following the date that is four months after the date of issue, the Warrants are subject to an acceleration clause in the event the closing price of Lupaka Gold's common shares is greater than $0.30 for a period of 20 consecutive trading days. Lupaka Gold may accelerate the expiry date of the warrants by giving notice to the holders thereof through the issuance of a press release. In such case the Warrants will expire on the 30th day after the date on which such notice is given.

Gordon Ellis, Eric Edwards, Darryl Jones and Geoff Courtnall, Directors, Officers and Insiders of the Company, acquired Units under the Placement. Their participation is considered to be a "related party transaction" as defined under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions. The transaction is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the Units issued to them, or the consideration paid, exceeded 25% of the Company's market capitalization.

Finders' fees to arm's-length parties in connection with the Placement consists of 210,857 Common Shares issued.

The shares and Warrants issued in the Placement are subject to a four-month hold period.

Proceeds from the Placement will be used for general corporate working capital.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The Securities have not been and will not be registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless an exemption from such registration is available.

About Lupaka Gold

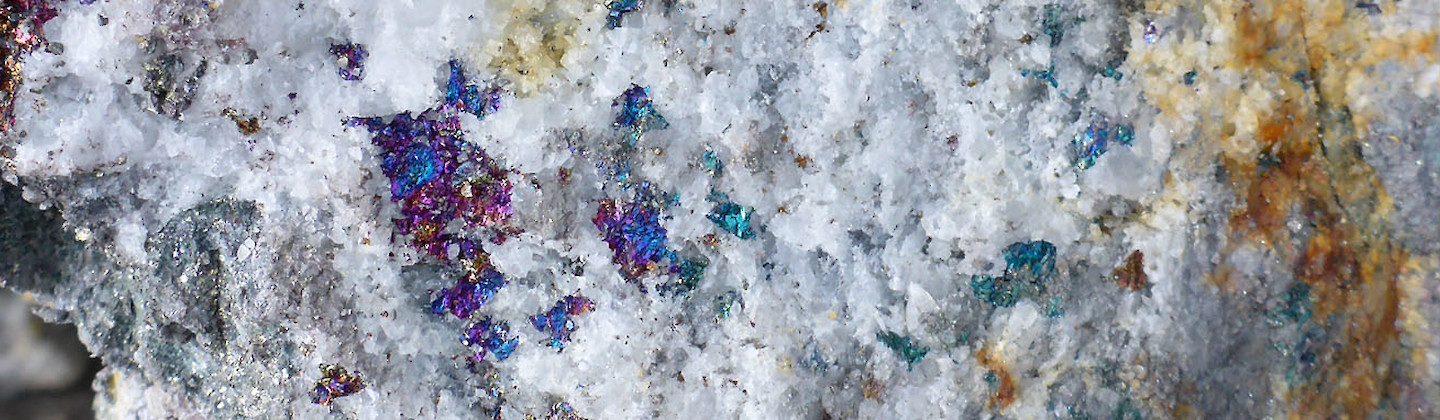

Lupaka Gold is a Peru-focused gold explorer and developer with geographic diversification and balance through its interest in asset-based resource projects spread across three regions of Peru.

The Company's 100%-owned Invicta Gold Project is located approximately 120 kilometres by road north of Lima. The resource estimate for Invicta shows a Measured resource estimate of 131,000 tonnes grading 6.65 grams per tonne ("g/t") gold equivalent for 28,000 contained ounces of gold. As well, the Invicta resource estimate shows an Indicated resource estimate of 8,513,000 tonnes grading 3.43 g/t gold equivalent for 939,000 contained ounces of gold and an Inferred resource estimate of 2,534,000 tonnes grading 2.90 g/t gold equivalent for 236,000 contained ounces of gold. See Table 1 below and the technical report dated April 16, 2012, titled "Technical Report on Resources, Invicta Gold Project, Huaura Province, Peru", and prepared by SRK Consulting (U.S.) Inc. ("SRK Technical Report"), which is available at www.sedar.com under Lupaka Gold Corp's profile.

Table 1: Invicta Gold Project: Summarized extract from the SRK Technical Report, detailing the above-mentioned resource estimate

Zone | Resource Category | Tonnes (000's) | Metal Grade | Contained Metal (000's) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AuEq (g/t) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AuEq Oz | Au Oz | Ag Oz | Cu Lbs | Pb Lbs | Zn Lbs | ||||

Total ‐ All Zones | Measured Indicated M + I Inferred | 131 8,513 8,644 2,534 | 6.65 3.43 3.48 2.90 | 4.29 2.09 2.13 1.61 | 31.71 15.65 15.90 12.02 | 0.73 0.42 0.43 0.46 | 0.39 0.24 0.24 0.27 | 0.38 0.28 0.29 0.18 | 28 939 967 236 | 18 573 591 131 | 133 4,285 4,418 979 | 2,119 79,048 81,167 25,879 | 1,110 45,171 46,281 14,891 | 1,105 53,482 54,587 9,854 | |

*Notes:

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimate will be converted into a Mineral Reserves estimate;

- Resources stated as contained within potentially economically mineable underground solids stated above a 1.3g/t Au Equivalent cut-off;

- The resource is stated at a 1.30 g/t gold equivalent cut-off contained within potentially economically mineable mineralized solids. Metal prices assumed for the gold equivalent calculation are US$1,500/oz for gold, US$32.50/oz for silver, US$3.90/lb for copper, US$1.05/lb for lead and US$1.00/lb for zinc. The gold equivalent calculation assumes 100% metallurgical recovery, and does not account for any smelting, transportation or refining charges. Metal prices used in the mineral resource estimate completed in October 2012 are significantly lower than current spot metal prices and this may materially impact any current mineral resource estimates;

- Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

The Company holds an option to earn a 65% interest on the Josnitoro Gold Project from Hochschild Mining PLC. The project is located approximately 600 kilometres by road southeast of Lima in the Department of Apurimac, southern Peru. Historical work on the disseminated gold zones includes over 170 shallow drill holes and extensive surface trenching.

Lupaka Gold holds a 100% interest in the Crucero Gold Project, a 5,500 hectare gold property located in southern Peru. Crucero has an Indicated mineral resource estimate of 1,003,041 ozs Au contained in 30,919,873 tonnes at 1.02 gpt gold (capped) and an Inferred mineral resource estimate of 1,027,806 ozs Au contained in 31,201,648 tonnes at 1.03 gpt gold (capped). These mineral resource estimates have been constrained by a conceptual pit shell in order to confirm reasonable prospects of economic extraction as set out in the CIM Definition Standards for Mineral Resources and Mineral Reserves and NI 43-101.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.

Investor Relations

+1 (604) 681-5900

or visit the Company's profile at www.sedar.com or its website at www.lupakagold.com

Qualified Person

The technical information in this document has been reviewed and approved by Julio Castañeda Mondragon, MAIG, the President of Lupaka Gold Peru S.A.C., a Peruvian subsidiary of the Company, and a Qualified Person as defined by National Instrument 43-101. Mr. Castañeda has verified the scientific and technical information, including sampling, analytical and test data underlying the information or opinions contained in this news release.

The Invicta Gold Project resource estimates referred to in this news release are disclosed in the technical report dated April 16, 2012, titled "Technical Report on Resources, Invicta Gold Project, Huaura Province, Peru", and prepared by SRK Consulting (U.S.) Inc., which is available at www.sedar.com under Lupaka Gold Corp's profile.

The Crucero A-1 mineral resource estimates referred to in this news release are disclosed in the technical report with effective date January 17, 2013, amended and re-stated October 22, 2013, titled "Technical Report for the Crucero Property, Carabaya Province, Peru", and prepared by Tetra Tech WEI Inc. and SRK Consulting (Canada) Inc., which is available at www.sedar.com under Lupaka Gold's profile.

Forward Looking Information and Regulatory Endnotes

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). The forward-looking information contained in this news release is made as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Forward-looking information in this news release includes all of the plans and expectations described above regarding the exploration and development of the Company's properties, including the commencement of planned mining operations at the Invicta Gold Project, and estimates of mineral resources. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "projects", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. The forward-looking information contained in this news release is based on certain assumptions that the Company believes are reasonable, including: that supplies, equipment, personnel, permits, required financing and local community approvals required to conduct the Company's planned exploration and development activities will be available on reasonable terms; that the results of exploration activities will be consistent with management's expectations and that the Company will not experience any material accident, labour dispute, or failure of equipment and with respect to the planned mining operations at Invicta; that pre-production mine development can be completed in the time and for the cost projected; that the Company will be able to obtain funding for planned production expenses; that mineralization on the Invicta project will be of the grades and in the locations expected; that the Company will be able to extract and transport mineralized rock efficiently and sell the mineralized rock at the prices and in the manner and quantities expected; that permits will be received on the terms and timeline expected and that other regulatory or permitting issues will not arise; that mining methods can be employed in the manner and at the costs expected and that such methods yield the results the Company expects them to; and that supplies, equipment, personnel, permits and local community approvals required to develop and conduct the planned production will be available on reasonable terms. The Company's assumptions with respect to mineral resource estimates include all of the key assumptions and parameters on which such estimates are based, as described in the technical report referred to in this news release. However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks, uncertainties and other factors include, among others: all of the risks described in this news release; the risk that actual results of exploration activities will be different than anticipated; that cost of labour, equipment or materials will increase more than expected; that the future price of gold will decline; that the Canadian dollar will strengthen against the U.S. dollar; that mineral resources are not as estimated; unexpected variations in mineral resources, grade or recovery rates; risks related to shipping mineralized rock; the risk that local mills cannot or will not buy or process mineralized rock from the planned production for the prices expected or at all; risk of accidents, labour disputes and other risks generally associated with mineral exploration; unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing; and all of the risks generally associated with the development of mining facilities and the operation of a producing mine, as well as the risks described in the Company's annual information form, which is available on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.