VANCOUVER, BRITISH COLUMBIA, March 28, 2014 -- Lupaka Gold Corp. ("Lupaka Gold" or "the Company") (TSX:LPK, BVL:LPK, FRA:LQP) reports performance highlights and financial results for the year ended December 31, 2013.

The following is taken from the Company's Audited Consolidated Financial Statements and Management's Discussion and Analysis, both of which are filed at www.sedar.com.

Overall Performance

The Company's recent activities and events of note for the fourth quarter are as follows:

- The Company finished the year with $3.906 million in cash.

- On March 17, 2014, the Company announced that it was commencing the permitting process to put the Invicta Gold Project in production on a small-scale basis of approximately 300 tonnes/day;

- The Company provided an update on January 20, 2014 of its 2014 development and exploration plans for its gold projects;

- On November 26, 2013, the Company announced that it had entered into a memorandum of understanding with certain subsidiaries of Hochschild Mining plc ("Hochschild")) with regards to the execution of a definitive agreement that will allow the Company to earn-in to a 65% interest in the Josnitoro Gold Project in Southern Peru (see "Mineral Projects" below for additional details);

- The Company announced on October 28, 2013 that it had completed a conceptual pit analysis and applied the findings to a pit-constrained resource estimate for the Crucero Gold Project, and that an updated and amended technical report supporting the Crucero Gold Project resource estimate had been filed on SEDAR (see www.sedar.com for a complete copy of the related Technical Report);

Lupaka Gold's common shares trade in Canada on the Toronto Stock Exchange ("TSX") and in Peru on the Bolsa de Valores de Lima ("BVL", otherwise known as the Lima Stock Exchange) under the symbol LPK, and in Germany on the Frankfurt Exchange ("FRA") under the symbol LQP. Lupaka Gold's share purchase warrants trade on the TSX under the symbol LPK.WT.

Outlook

The Company's primary priorities for 2014 are to: implement its small-scale production option for the Invicta Gold Project; continue mineral exploration and development activities on the Crucero Gold Project and Josnitoro Gold Project; and to maximize the potential return on its investment in Southern Legacy Minerals Inc. ("Southern Legacy").

Management also believes that cash and cash equivalents on hand as at the above-referenced date will be sufficient to fund the Company's planned head office and Peru exploration activities for the balance of 2014, by delaying drilling activity and reducing or eliminating discretionary expenses related to administration and exploration.

Financial Highlights

All amounts are in Canadian Dollars unless otherwise stated.

Financial results for the years ended December 31, 2013 and 2012 are summarized as follows:

Years ended December 31, | |||

| In thousands of dollars | 2013 | 2012 | |

| Operating expenses | |||

| Exploration | 5,326 | 5,475 | |

| General and administration | 2,968 | 2,673 | |

| Operating loss | 8,294 | 8,148 | |

| Impairment loss on available-for-sale financial asset | 1,657 | 1,476 | |

| Finance expense - accretion | - | 22 | |

| Finance income - interest | (60) | (58) | |

| Foreign exchange loss (gain) | (109) | 8 | |

| Loss for the period | 9,782 | 9,596 | |

| Loss per share - Basic and diluted | $0.12 | $0.18 | |

Overall, the loss for the year ended December 31, 2013 was slightly larger than for the comparative period in 2012, as a result of increased expenses in the areas of investor relations, impairment losses on the Company's investment in Southern Legacy, and inclusion of Invicta exploration expenses for a full year, offset by there being no corporate development and drilling expenses in 2013.

Exploration - all such expenses relate to the Peru operations of the Company and totalled $5,326,000 for 2013 compared to $5,475,000 for 2012, a net decrease of $149,000 for the period as a result of an increase of $1,707,000 for project administration and camp and community relations costs due to the addition of the Invicta Gold Project in October 2012 and $552,000 in community relations contractor, access payments and project costs related to the Crucero Gold Project, offset by a decrease of $1,856,000 in drilling and related costs as no drilling has been conducted in 2013.

Following is a summary of exploration expenditures, by project, during the year ended December 31, 2013:

| In thousands of dollars | Crucero | Invicta | Total |

| Project administration | 1,617 | 1,156 | 2,772 |

| Camp, community relations and related costs | 1,567 | 566 | 2,134 |

| Technical reports, assays and related costs | 285 | 35 | 320 |

| Transportation, reclamation and professional fees | 71 | 29 | 100 |

3,540 | 1,786 | 5,326 |

General and administration expenses - all such expenses relate to the Canadian operations of Lupaka Gold and totalled $2,968,000 for 2013 compared to $2,673,000 for 2012. The net increase of $295,000 was due to an increase of $581,000 reflecting the costs of investor relations programs implemented in the second and third quarter and offset by decreases of $108,000 in salaries and benefits, professional and regulatory fees, office and general, and travel (primarily due a decrease of $109,000 in related share-based compensation expense) and $177,000 in corporate development expenses compared to 2012. In 2012, there was $177,000 in Andean American due diligence costs and in 2013, there were none.

Investment in Southern Legacy Minerals Ltd. - as a result of the AAG acquisition, the Company acquired 9,841,269 common shares in Southern Legacy, representing approximately 17% of the issued and outstanding ownership shares of Southern Legacy, and which the Company classifies as an available-for-sale financial asset. At the October 1, 2012, date of initial recognition, the fair market value of this investment was $3,986,000.

On October 22, 2013, the Company acquired an additional 208,333 common shares in Southern Legacy at a cost of $52,000. As a result of this acquisition, the Company owns a total of 10,049,602 common shares in Southern Legacy, representing approximately 17% of the issued and outstanding ownership shares of Southern Legacy.

As at December 31, 2013, the aggregate fair market value of this investment was $904,000 ($2,510,000 - December 31, 2012), as indicated by the closing price of the shares as quoted by the TSX Venture Exchange (under the symbol, "LCY"), for which the Company recorded impairment losses of $1,657,000 ($1,476,000 - 2012) during the year. Southern Legacy's common shares also trade on the BVL.

The Company continues to evaluate its strategic options regarding this portfolio investment.

A snapshot of the Company's balance sheet is as follows:

| In thousands of dollars | December 31, 2013 | December 31, 2012 | |

| Cash and cash equivalents | 3,906 | 10,716 | |

| Working capital (defined as current assets less current liabilities) | 2,502 | 9,737 | |

| Total assets | 33,106 | 42,780 | |

| Current liabilities | 1,777 | 1,563 | |

| Shareholders’ equity | 31,106 | 41,217 | |

The principal changes in the Company's cash during the year ended December 31, 2013 were as follows:

- Cash used in operating activities in the year ended December 31, 2013 was $6,650,000 ($8,081,000 - 2012), principally to fund the Company's loss for the period of $9,782,000 ($9,596,000 - 2012) which was offset by non-cash charges including depreciation of $350,000 ($128,000 - 2012), the impairment loss on the investment in Southern Legacy of $1,657,000 ($1,476,000 - 2012), share-based compensation of $618,000 ($854,000 - 2012), other miscellaneous non-cash expenses of $82,000 ($(10,000) - 2012), as well as net changes in non-cash working capital of an increase of $425,000 (decrease of $940,000 - 2012);

- Net cash used in investing activities in the year ended December 31, 2013 totalled $149,000 from purchases of equipment for $107,000, sales of equipment for $10,000 and $52,000 for the acquisition of additional common shares of Southern Legacy, as compared to net cash from investing activities in the year ended December 31, 2012 totalling $9,366,000, primarily a result of the cash acquired on the acquisition of Andean American on October 1, 2012 of $13,502,000 offset by LGP acquisition costs of $3,057,000, equipment purchases of $309,000 and $770,000 in due diligence and related transaction costs pursuant to the acquisition of Andean American; and

- The Company had no cash flows from or used in financing activities in the year ended December 31, 2013. Net cash used in financing activities during 2012 totalled $4,026,000, resulting from the payment of $4,076,000 (US $4 million) for the remaining 40% of LGP that it did not already own and proceeds from the exercise of stock options of $50,000.

Total current liabilities as at December 31, 2013 were $1,777,000 ($1,563,000 - December 31, 2012), comprised of $1,406,000 ($1,019,000 - December 31, 2012) of accounts payable and accrued liabilities, mostly for current community obligations, and $371,000 of provisions for reclamation ($544,000 - December 31, 2012).

Management believes that cash and cash equivalents on hand as at March 26, 2013 will be sufficient to fund the Company's planned head office and Peru exploration activities through the balance of 2014. If required, the Company can adjust its discretionary expenditures in the areas of administration and exploration to preserve cash.

Outstanding Share Data

As at March 26, 2014, the following securities were issued and outstanding:

- basic - 84,495,110 common shares

- fully-diluted - 99,766,627 common shares, after including:

- 7,992,350 stock options, with exercise prices ranging from $0.20 to $4.08, of which 5,989,850 options are vested; and

- 7,279,167 share purchase warrants, with a weighted average exercise price of $2.22.

Accumulated Deficit

The Company's accumulated deficit was $29,321,000 as at December 31, 2013 ($19,539,000 - December 31, 2012), with the increase in deficit of $9,782,000 reflecting the loss incurred for the year ended December 31, 2013.

About the Company

Lupaka Gold is a Peru-focused gold explorer with geographic diversification and balance through its interest in asset-based resource projects spread across three regions of Peru.

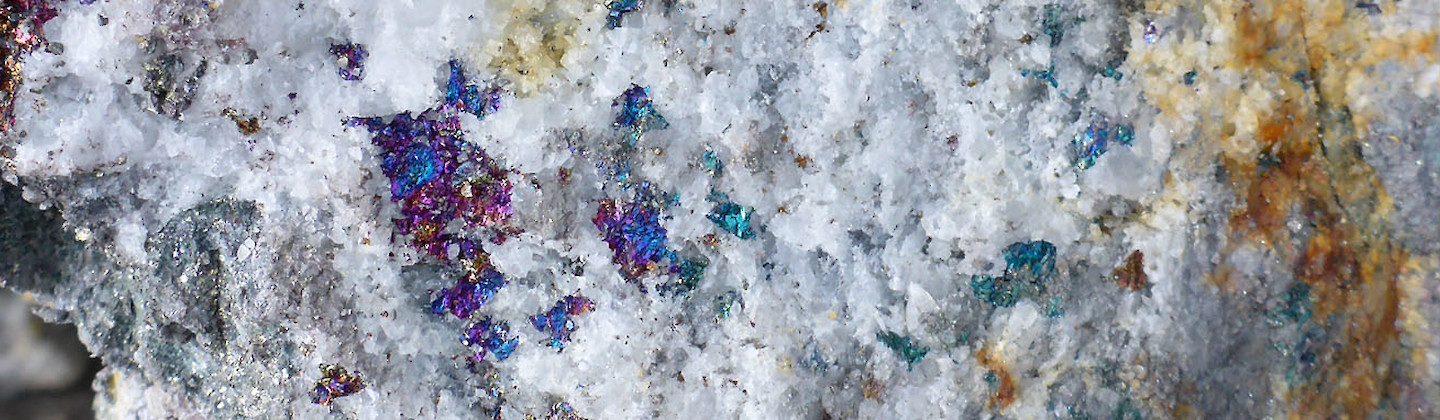

Lupaka Gold's flagship project is the Crucero Gold Project, its 5,500 hectare gold property located in southern Peru. The Company, based in Vancouver, Canada, is project operator and holds a 100% indirect interest in the Crucero Gold Project. Since commencing active exploration in April 2010, the Company has reported annual NI 43-101 compliant gold resource estimate increases for the Crucero Gold Project in the first quarter of 2011 and 2012 (see the Company's most recent technical report on www.sedar.com).

As a result of the Company's 2012 acquisition of Andean American Gold Corp., Lupaka Gold's assets now include the 100% owned Invicta Gold Project (north Peru), which has near-term underground gold and poly-metallic development potential, and a strategic 17% stake in Southern Legacy Minerals Inc., owner of the AntaKori copper-gold deposit located in central Peru.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.

Investor Relations

+1 (604) 681-5900, e-mail: gold@lupakagold.com or visit the Company's website at www.lupakagold.com.

Forward Looking Information and Regulatory Endnotes

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). The forward-looking information contained in this news release is made as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Forward-looking information includes, but is not limited to, statements with respect to exploration plans and timing for Crucero, the grant of social license and exploration plans for Josnitoro, a potential mining operation at Invicta and estimates of mineral resources. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "projects", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved.

The forward-looking information contained in this news release is based on certain assumptions that the Company believes are reasonable, including with respect to mineral resource estimates, the key assumptions and parameters on which such estimates are based, that that the current price of and demand for gold will be sustained or will improve, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed on reasonable terms, that supplies, equipment, personnel, permits and local community approvals required to conduct the Company's planned exploration and development activities will be available on reasonable terms, that results of exploration activities will be consistent with management's expectations and that the Company will not experience any material accident, labour dispute, or failure of equipment. However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risk that actual results of exploration activities will be different than anticipated, that cost of labour, equipment or materials will increase more than expected, that the future price of gold will decline, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources are not as estimated, unexpected variations in mineral resources, grade or recovery rates, risk of accidents, labour disputes and other risks generally associated with mineral exploration and unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.

This announcement contains certain forward looking statements, including such statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In particular, such forward looking statements may relate to matters such as the business, strategy, investments, production, major projects and their contribution to expected production and other plans of the Company and its current goals, assumptions and expectations relating to its future financial condition, performance and results.

Forward-looking statements include, without limitation, statements typically containing words such as "intends", "expects", "anticipates", "targets", "plans", "estimates" and words of similar import. By their nature, forward looking statements involve risks and uncertainties because they relate to events and depend on circumstances that will or may occur in the future. Actual results, performance or achievements of the Company may be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Factors that could cause or contribute to differences between the actual results, performance or achievements of the Company and current expectations include, but are not limited to, legislative, fiscal and regulatory developments, competitive conditions, technological developments, exchange rate fluctuations and general economic conditions. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser.

The forward looking statements reflect knowledge and information available at the date of preparation of this announcement. Except as required by the Listing Rules and applicable law, the Company does not undertake any obligation to update or change any forward looking statements to reflect events occurring after the date of this announcement. Nothing in this announcement should be construed as a profit forecast.