NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BRITISH COLUMBIA, February 22, 2016 -- Lupaka Gold Corp. ("Lupaka Gold" or the "Company") (TSX.V:LPK, FRA:LQP) announces that it has closed the non-brokered private placement ("Placement") previously announced on February 11, 2016.

Additionally, the Company has completed its second run-of-mine bulk test of 532 tonnes achieving total recoveries of 87.52% for Gold, 91.18% for Silver and 91.52% for Copper. The tests were run under the supervision of an independent metallurgist, at a local toll mill in Nazca, south of Lima, Peru.

Closing of Private Placement

The Company issued 8,390,000 units (the "Units") at a price of $0.05 for gross proceeds of $419,500. Each Unit consists of one common share and one transferable common share purchase warrant (each, a "Warrant"). Each Warrant entitles the holder to purchase one additional common share, exercisable at $0.10 for a period of thirty-six months from closing.

At any time following the date that is four months after the date of issue, the Warrants are subject to an acceleration clause in the event the closing price of Lupaka Gold's common shares is greater than $0.30 for a period of 20 consecutive trading days. Lupaka Gold may accelerate the expiry date of the warrants by giving notice to the holders thereof through the issuance of a news release. In such case the Warrants will expire on the 30th day after the date on which such notice is given.

No Insiders participated in this Placement, and finders' fees to arm's-length parties in connection with the Placement consist of $16,110 in cash. The shares and Warrants issued in the Placement are subject to a four-month hold period.

Proceeds from the Placement will be used for general working capital purposes in Canada and to further the Company's Invicta Gold Project.

Mr. Gordon Ellis, President and CEO of Lupaka Gold commented "We were originally aiming for $300,000 in funding from this private placement but the enthusiastic reception from investors resulted in the oversubscription to a total of $419,500. We thank our new and repeat shareholders for their support. Together with a successful closing of the Pandion financing opportunity, we will be able to move Invicta forward to near-term production."

Second Run-of-Mine Bulk Test Results

A single bulk copper concentrate was produced with concentrate tonnes and grades per tonne achieved as shown below in Table 1.

Table 1

Concentrate tonnes and grades per tonne from the 532t bulk sample

| Concentrate | Concentrate | Au(1) | Ag(1) | Cu(1) | Pb(2) | Zn(2) |

| Stream | >DMT | g/t | g/t | % | % | % |

| Copper (Cu) | 47.58 | >58.5 | 648 | 15.2 | 11.11 | > 9.63 |

(1) Based on a Mineral Assay Report prepared by ALS Perú S.A.

(2) Based on results obtained by the processor, Mineria y Exportaciones SAC ("Minex")

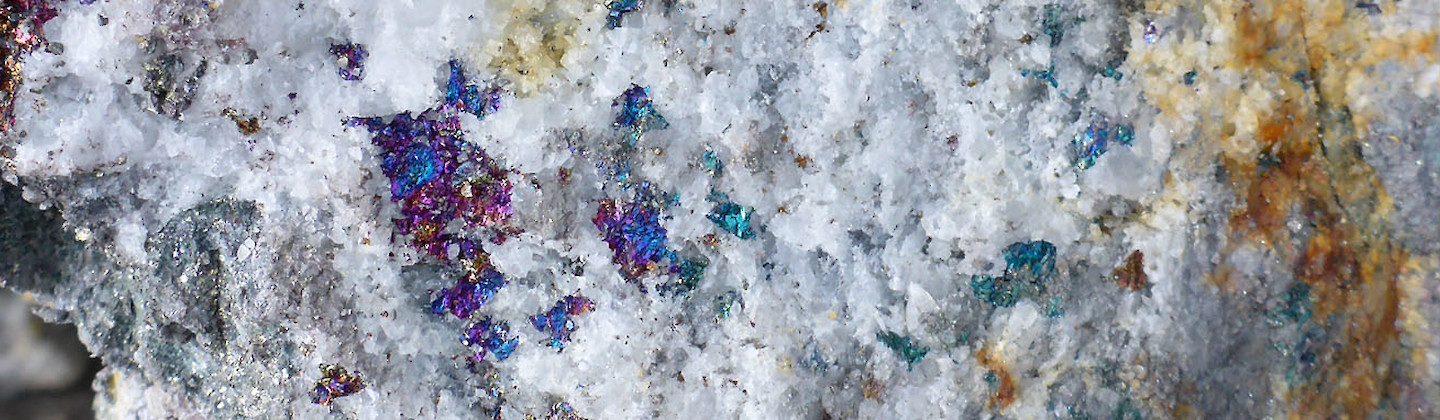

"This is our second bulk test of primarily run of mine material from the Atenae vein at Invicta. The sample is a blend of approximately 80 percent run-of-mine material and 20 percent from an existing low grade stock pile derived from development of existing workings. The mineralized rock was processed with the prime objective of producing a saleable concentrate and no effort was made to optimize content of specific metals. The resulting concentrate was exceptionally clean, with virtually no penalty elements and, as such, is ideal for sale and blending with other concentrates." commented Mr. Gordon Ellis, President and CEO of Lupaka Gold.

Recovery

Overall average percentage recovery for each target metals in the concentrate are shown below in Table 2.

Table 2

Distribution of Metal - Recovery of Metal in Concentrate Streams

| Concentrate Stream | Au | Ag | Cu | Pb | Zn |

| % | |||||

| Copper | 87.52 | 91.18 | 91.52 | 90.03 | 90.13 |

"As stated earlier, we are pleased with these results and particularly with the cleanliness of the concentrates. Bench tests previously carried out by the Company's independent metallurgists indicate that individual metal recoveries can be further improved to increase profitability. Processing adjustments will continue to be made as we move forward", continued Mr. Ellis.

Toll Process Plant Used

The Company completed the process test at the Minex processing plant located in Nazca, south of Lima, Peru. The total tonnage received at the processing plant was 532 tonnes of which 432 tonnes was from recently extracted run-of-mine material and 100 tonnes was from low grade stockpiled material. This processing plant has only one processing system, resulting in all of the material being blended and run as a single test.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release.

About Lupaka Gold

Lupaka Gold is a Peru-focused gold explorer and developer with geographic diversification and balance through its interest in asset-based resource projects spread across three regions of Peru.

The Company's 100%-owned Invicta Gold Project is located approximately 120 kilometres by road north of Lima. The resource estimate for Invicta shows a Measured resource estimate of 131,000 tonnes grading 6.65 grams per tonne ("g/t") gold equivalent for 28,000 contained ounces of gold. As well, the Invicta resource estimate shows an Indicated resource estimate of 8,513,000 tonnes grading 3.43 g/t gold equivalent for 939,000 contained ounces of gold and an Inferred resource estimate of 2,534,000 tonnes grading 2.90 g/t gold equivalent for 236,000 contained ounces of gold.

The Company holds an option to earn a 65% interest on the Josnitoro Gold Project from Hochschild Mining PLC. The project is located approximately 600 kilometres by road southeast of Lima in the Department of Apurimac, southern Peru. Historical work on the disseminated gold zones includes over 170 shallow drill holes and extensive surface trenching.

Lupaka Gold holds a 100% interest in the Crucero Gold Project, a 5,500 hectare gold property located in southern Peru. Crucero has an Indicated mineral resource estimate of 1,003,041 ozs Au contained in 30,919,873 tonnes at 1.02 gpt gold (capped) and an Inferred mineral resource estimate of 1,027,806 ozs Au contained in 31,201,648 tonnes at 1.03 gpt gold (capped). These mineral resource estimates have been constrained by a conceptual pit shell in order to confirm reasonable prospects of economic extraction as set out in the CIM Definition Standards for Mineral Resources and Mineral Reserves and NI 43-101.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.

Investor Relations

+1 (604) 681-5900

or visit the Company's profile at www.sedar.com or its website at www.lupakagold.com

Qualified Person

The technical information in this document has been reviewed and approved by Julio Castañeda Mondragon, MAIG, the President of Invicta Mining Corporation S.A.C., a Peruvian subsidiary of the Company, and a Qualified Person as defined by National Instrument 43-101. Mr. Castañeda has verified the scientific and technical information, including sampling, analytical and test data underlying the information or opinions contained in this news release.

The Invicta Gold Project resource estimates referred to in this news release are disclosed in the technical report dated April 16, 2012, titled "Technical Report on Resources, Invicta Gold Project, Huaura Province, Peru", and prepared by SRK Consulting (U.S.) Inc., which is available at www.sedar.com under Lupaka Gold Corp's profile.

The Crucero A-1 mineral resource estimates referred to in this news release are disclosed in the technical report with effective date January 17, 2013, amended and re-stated October 22, 2013, titled "Technical Report for the Crucero Property, Carabaya Province, Peru", and prepared by Tetra Tech WEI Inc. and SRK Consulting (Canada) Inc., which is available at www.sedar.com under Lupaka Gold's profile.

Cautionary Note Regarding the Invicta Production Decision

The decision to commence production at the Invicta Gold Project and the Company's plans for a mining operation as referenced herein (the "Production Decision and Plans") were based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing preliminary estimate of measured, indicated and inferred mineral resources on the property. The Production Decision and Plans were not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Plans, in particular the risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations are more difficult or more expensive than expected, the risk that the Company will not be able to transport or sell the mineralized rock it produces to local custom toll mills on the terms it expects, or at all; production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis according to and in accordance with NI 43-101.

Cautionary Statements Regarding Forward Looking Information

All statements, trend analysis and other information contained in this news release relative to markets and anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, including, without limitation, statements relating to the anticipated use of proceeds of the Placement and statements regarding the exploration and mineralization potential of the Invicta property, are forward-looking statements. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Lupaka Gold's expectations include fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and community groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; and uncertainty as to timely availability of permits and other governmental approvals. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Lupaka Gold does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.