VANCOUVER, BRITISH COLUMBIA, March 17, 2014 - Lupaka Gold Corp ("Lupaka Gold" or the "Company") (TSX:LPK, BVL:LPK, FRA:LQP) is pleased to announce that it intends to initiate a small-scale mining operation at the Invicta Gold Project at a rate of 300 tonnes per day ("t/d") by Q1-2015.

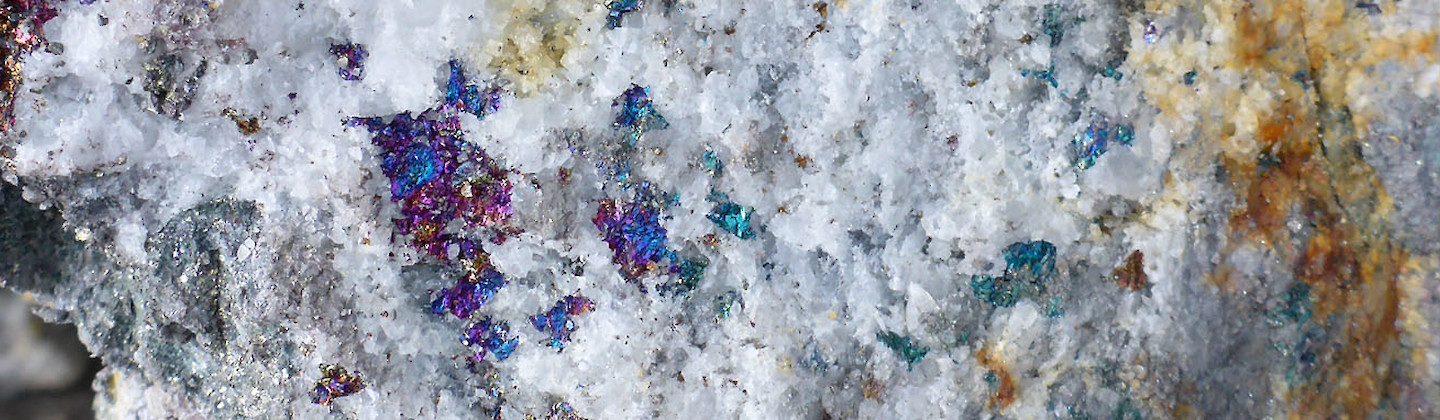

The Company intends to commence production by using the existing 1.2 km of tunnels, utilizing contracted third-party mining, development and haulage, and sell the mineralized rock to a local mill for processing. This contract-mining strategy will significantly minimize required capital, surface disturbance, while reducing the impact on the local community. The Company forecasts that production can be commenced at a total cost of less than $2.0 million. Production is planned to initially target some of the highest grade gold and copper mineralization within the Atenea Vein, which contains the majority of the current Invicta gold resource.

Invicta Gold Project production plan highlights:

- Mine permitting, engineering, development and infrastructure costs of less than $2.0 million, funded from the Company's treasury and/or alternative financing sources;

- Preparing and submitting an operating permit under the small miner exemption in Peru, which is available for operations of up to 350 t/d;

- Securing necessary permits within 7 months by modifying/utilizing the Company's existing Environmental Impact Assessment for Mine Operations, Archeological Certificate, Water License and Community Agreement;

- Contractor pre-production mine development would commence after receiving required permits and be completed within three months;

- Utilize the existing 1.2 km of tunnels, drifts, and cross cuts that access the Measured resource mineralization;

- Construction of mine safety, alternate escapes, and ventilation upgrades as part of the pre-production development;

- Utilizing a low-cost and scalable sub-level open stoping mining method;

- Commencing initial production by March 2015;

- Over the first 12 months, producing approximiately 100,000 tonnes of mineralized rock from the areas containing the Measured resource; and

- Shipping and selling mineralized rock directly to local custom toll mills, thereby avoiding capital cost and permit delays associated with plant construction, tailings and water impacts.

Eric Edwards, Lupaka Gold's CEO, commented that "the historical development work already provides us with access to an area containing some of the highest grade rock within the current resource. The considerable investment made by Invicta's previous owners has provided most of the infrastructure required for this proposed small-scale mining operation."

The current Invicta resource estimate shows a Measured resource of 131,000 tonnes grading 6.65 grams per tonne ("g/t") gold equivalent for 28,000 contained ounces of gold available from the in-situ development. As well, the current Invicta resource shows an Indicated resource of 8,513,000 tonnes grading 3.43 g/t gold equivalent for 939,000 contained ounces of gold and an Inferred resource of 2,534,000 tonnes grading 2.90 g/t gold equivalent for 236,000 contained ounces of gold. See Table 1 below and the technical report dated April 16, 2012, titled "Technical Report on Resources, Invicta Gold Project, Huaura Province, Peru", and prepared by SRK Consulting (U.S.) Inc. ("SRK Technical Report"), which is available at www.sedar.com under Lupaka Gold Corp's profile.

A portion of the Measured resource mineralization will initially be targeted by the planned production. The Company also intends to pursue further drilling from underground, concurrent with production, with the objective of upgrading inferred resources and providing additional data to inform mining direction and control decisions.

Table 1: Invicta Project: Summarized extract from the SRK Technical Report, detailing the above-mentioned resource estimate

| Zone | Resource Category | Tonnes (000's) | Metal | Contained Metal (000's) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AuEq (g/t) | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AuEq Oz | Au Oz | Ag Oz | Cu Lbs | Pb Lbs | Zn Lbs | |||

| Total - All Zones | Measured Indicated M + I Inferred | 131 8,513 8,644 2,534 | 6.65 3.43 3.48 2.90 | 4.29 2.09 2.13 1.61 | 31.71 15.65 15.90 12.02 | 0.73 0.42 0.43 0.46 | 0.39 0.24 0.24 0.27 | 0.38 0.28 0.29 0.18 | 28 939 967 236 | 18 573 591 131 | 133 4,285 4,418 979 | 2,119 79,048 81,167 25,879 | 1,110 45,171 46,281 14,891 | 1,105 53,482 54,587 9,854 |

*Notes:

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimate will be converted into a Mineral Reserves estimate;

- Resources stated as contained within potentially economically mineable underground solids stated above a 1.3g/t Au Equivalent cut‐off;

- The resource is stated at a 1.30 g/t gold equivalent cut‐off contained within potentially economically mineable mineralized solids. Metal prices assumed for the gold equivalent calculation are US$1,500/oz for gold, US$32.50/oz for silver, US$3.90/lb for copper, US$1.05/lb for lead and US$1.00/lb for zinc. The gold equivalent calculation assumes 100% metallurgical recovery, and does not account for any smelting, transportation or refining charges;

- Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding; and

- Mineral resource tonnage and grade are reported as diluted to reflect a potentially minable underground selective mining unit of 3.0m.

The Company will prepare and apply for a small mine operations permit in Peru that provides for mining operations of up to 350 tonne per day. The small mine permit approval process is administered through the local jurisdiction in the Department of Lima, and requires two public workshops for comment and local involvement. The permit application process requires similar studies as large-scale permits, i.e. environmental baseline, flora and fauna, archeological assessment, hydrology, hydrogeology, and others, but recognizes that the project has a much smaller surface and environmental disturbance and impact. Small mine permits can typically be prepared and approved within seven months.

The Company is in discussions and negotiations with a number of Peruvian mining contractors. A team to prepare the necessary small mine permits will be formed and contracted within the next month and should have the permit applications completed within 5 months. Community workshops will take place within the required timeframe.

Over the next several months and during the permit preparation/review process, the Company will complete mine engineering, contractor selections, staffing, training, road improvements, water system upgrades, and other activities leading toward operations. Critical to the contractor selection will be not only cost, but safety, environmental awareness, community and cultural sensitivity, permit compliance, references and experience, as well as other factors.

Mr. Edwards further commented that "Invicta remains a project with considerable unrecognized value, and with a successful implementation of an Invicta mining operation we believe that we will be able to interest an established miner in expanding to a larger-scale operation where Lupaka would hold a continuing carried interest."

Previous owners of the Invicta Gold property completed a number of technical studies including metallurgy, rock mechanics, structural geology on the mine area, hydrology, hydrogeology, power line from Andahuasi, and other engineering analysis.

The decision to commence production at the Invicta Gold property was based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing preliminary estimate of measured and inferred mineral resources on the property. The decision was not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with this production decision, in particular the risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations are more difficult or more expensive than expected, the risk that the Company will not be able to transport or sell the mineralized rock it produces to local custom toll mills on the terms it expects, or at all; production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis according to and in accordance with NI 43-101. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.

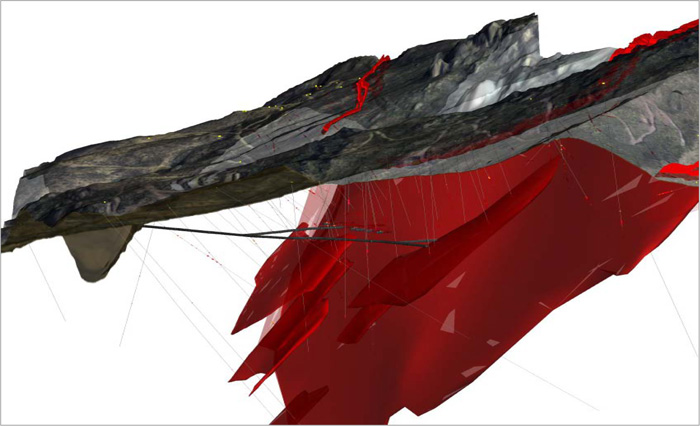

Figure 1: Invicta Project: Three dimensional view showing surface topography, underground projection of the main mineralized vein, and existing underground tunnels from surface to main vein

About Lupaka Gold

Lupaka Gold is a Peru-focused gold explorer and developer with geographic diversification and balance through its interest in asset-based resource projects spread across three regions of Peru.

As of December 31, 2013 Lupaka Gold had cash reserves of $3.85 million, sufficient to conduct planned exploration work and fund its operations during 2014.

Lupaka Gold currently has three projects occupying different stages of exploration and development.

The Company's 100% owned Invicta Gold Project (central Peru) has near-term underground gold and poly-metallic production potential. The Company plans to implement a small-scale mining operation and complete permitting, development and engineering with production to commence by Q1-2015.

Lupaka Gold's flagship exploration project is the Crucero Gold Project, its 5,500 hectare gold property located in southern Peru. Crucero has a growing indicated and inferred gold resource, and the Company is actively exploring the property to identify future drill targets.

In November 2013, the Company optioned the Josnitoro Gold Project from Hochschild Mining PLC. The project is located approximately 600 kilometres by road southeast of Lima in the Department of Apurimac, southern Peru. Historical work on the disseminated gold zones includes over 170 shallow drill holes and extensive surface trenching.

As a result of the Company's 2012 acquisition of Andean American Gold Corp., the Company also holds a strategic 17% stake in Southern Legacy Minerals Inc., owner of the AntaKori copper-gold deposit located in northern Peru.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.

Investor Relations

+1 (604) 681-5900

or visit the Company's website at www.lupakagold.com

Qualified Person

The technical information in this document has been reviewed and approved by Julio Castaneda, MAIG, the President of Lupaka Peru, a Peruvian subsidiary of the Company, and a Qualified Person as defined by National Instrument 43-101.

Forward Looking Information and Regulatory Endnotes

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). The forward-looking information contained in this news release is made as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Forward-looking information in this news release includes all of the plans and expectations described above regarding initiating mining operations at the Invicta Gold Project (the "planned production"), including but is not limited to: the timing and cost of completing pre-production mine development; the method of funding mine development and infrastructure costs; the mineralizations to be targeted; the existence of high-grade mineralizations and the depth of any such mineralization from the existing tunnels on the project; the Company's plans for shipping and selling mineralized rock from the planned production; all statements regarding the permits necessary for the planned production and the timing and conditions of receiving those permits; mining methods to be used for the planned production and the costs thereof; the date by which the Company expects the planned production to commence; and all quantities and rates of production. Forward-looking information also includes statements as to the sufficiency of current cash reserves to pay for planned exploration and fund future operations, as well as estimates of mineral resources. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "projects", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. The forward-looking information contained in this news release is based on certain assumptions that the Company believes are reasonable, including, with respect to the planned production: that pre-production mine development can be completed in the time and for the cost projected; that the Company will be able to fund expenses of the planned production from its current cash reserves; that mineralizations on the project will be of the grades and in the locations expected; that the Company will be able to extract and transport mineralized rock efficiently and sell the mineralized rock at the prices and in the manner and quantities expected; that permits will be received on the terms and timeline expected and that other regulatory or permitting issues will not arise; that mining methods can be employed in the manner and at the costs expected and that such methods yield the results the Company expects them to; that supplies, equipment, personnel, permits and local community approvals required to develop and conduct the planned production will be available on reasonable term; that the Company will not experience any material accident, labour dispute, or failure of equipment. The Company's assumptions with respect to mineral resource estimates include all of the key assumptions and parameters on which such estimates are based, as described in the technical report referred to in this news release. However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks , uncertainties and other factors include, among others: all of the risks described in this news release; the risk that actual results of exploration activities will be different than anticipated; that cost of labour, equipment or materials will increase more than expected; that the future price of gold will decline; that the Canadian dollar will strengthen against the U.S. dollar; that mineral resources are not as estimated; unexpected variations in mineral resources, grade or recovery rates; risks related to shipping mineralized rock; the risk that local mills cannot or will not buy or process mineralized rock from the planned production for the prices expected or at all; risk of accidents, labour disputes and other risks generally associated with mineral exploration; unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing; and all of the risks generally associated with the development of mining facilities and the operation of a producing mine; as well as the risks described in the Company's annual information form, which is available on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.

This announcement contains certain forward looking statements, including such statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In particular, such forward looking statements may relate to matters such as the business, strategy, investments, production, major projects and their contribution to expected production and other plans of Hochschild Mining plc and its current goals, assumptions and expectations relating to its future financial condition, performance and results.

Forward-looking statements include, without limitation, statements typically containing words such as "intends", "expects", "anticipates", "targets", "plans", "estimates" and words of similar import. By their nature, forward looking statements involve risks and uncertainties because they relate to events and depend on circumstances that will or may occur in the future. Actual results, performance or achievements of Hochschild Mining plc may be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Factors that could cause or contribute to differences between the actual results, performance or achievements of Hochschild Mining plc and current expectations include, but are not limited to, legislative, fiscal and regulatory developments, competitive conditions, technological developments, exchange rate fluctuations and general economic conditions. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser.

The forward looking statements reflect knowledge and information available at the date of preparation of this announcement. Except as required by the Listing Rules and applicable law, Hochschild Mining plc does not undertake any obligation to update or change any forward looking statements to reflect events occurring after the date of this announcement. Nothing in this announcement should be construed as a profit forecast.