VANCOUVER, BRITISH COLUMBIA, December 3, 2019 – Lupaka Gold Corp. ("Lupaka Gold" or the “Company") (TSX-V: LPK, FRA: LQP).

We reference the Company’s August 27, 2019 news release wherein the Company provided news on the sale of PLI Huaura LC (“PLI”) to Lonely Mountain Resources SAC (“Lonely Mountain”), and its declaration of an early termination date of the PLI Loan under which the Company received US$6.1 million (net). With its unexpected and unilateral declaration of an early termination date, PLI immediately demanded that the Company pay PLI US$15,581,654 and initiated foreclosure proceedings on various assets of the Company held as collateral. PLI has now completed certain foreclosure procedures, which resulted in the transfer of all of the ownership shares of Invicta Mining Corp., which holds the Invicta Gold Project, to PLI.

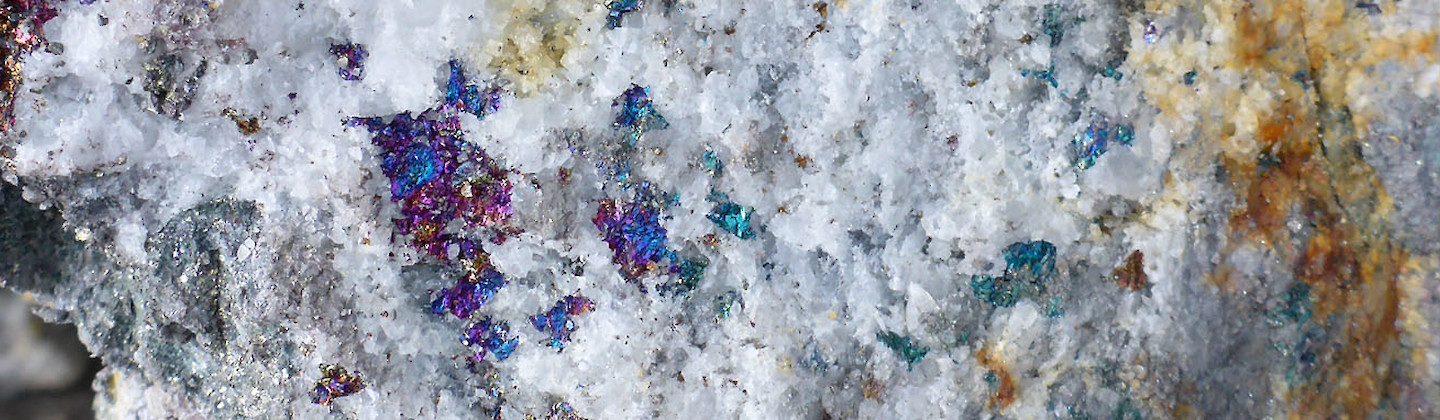

The Company considers that these actions by PLI are a consequence of the illegal blockade erected by the Paran Community wherein the Community prevented any access to the Company’s Invicta mine site. The Company had begun its planned shipments from the mine to processing plants in the third quarter of 2018, but such shipments were suspended as a result of the illegal Paran Community blockade which began in October 2018. Without access to the mine site, Lupaka was unable to continue mining, shipping and processing the mine’s mineralized rock, and thereby create operating cash flow with which to commence payments on the PLI Loan, which were scheduled to begin during the first quarter of 2019. Despite numerous requests for assistance from and meetings with government officials of the Republic of Peru, the requested assistance was not provided and the blockade appears to continue to this day.

Mr. Gordon Ellis, CEO, commented, “There can be no doubt that the Company’s loss of the Invicta Gold Project is a direct consequence of the Paran Community’s ongoing blockade preventing access to the Invicta project”. He continued, “If we had been able to continue transporting Invicta’s mineralized rock as planned, sufficient cash flow would have been generated to meet the necessary conditions of the PLI Loan. In this regard, we believe that Lupaka Gold has been wronged not only by the manner and actions by which PLI undertook their foreclosure proceedings but, moreover, by the inactions of the Peru Government in not ensuring that the Company’s concession and property rights were protected, at a minimum, pursuant to the Canada-Peru Free Trade Agreement (“CPFTA”). The Company reserves all rights under Peruvian and international law.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Gordon Ellis, C.E.O.

gellis@lupakagold.com

Tel: (604) 985-3147

or visit the Company’s profile at www.sedar.com