VANCOUVER, BRITISH COLUMBIA, August 14, 2015 - Lupaka Gold Corp. ("Lupaka Gold" or "the Company") (TSX.V:LPK, BVL:LPK, FRA:LQP) reports performance highlights and financial results for the six months ended June 30, 2015.

The following is taken from the Company's Consolidated Financial Statements and Management's Discussion and Analysis, both of which are filed at www.sedar.com.

Overall Performance

The Company's events of note for the six months ended June 30, 2015 and to date are as follows:

- The Company announced on April 9, 2015 that it had received approval from the community of Lacsanga to proceed with development and other pre-production activities at the Invicta Gold Project which affect their community;

- On February 25, 2015, the Company announced that it had been granted a Certificate of Mining ("COM") permit for mining and development work activities at the Invicta Gold Project; and

- The Company announced on February 17, 2015 that its common shares would be delisted from the Toronto Stock Exchange after the close of trading that day and immediately listed on the TSX Venture Exchange with no interruption in trading. The decision to move to TSX.V was made to reduce the Company's costs of maintaining its listing and for greater flexibility as the Company pursues its growth strategy;

Lupaka Gold's common shares trade in Canada on the TSX.V and in Peru on the Bolsa de Valores de Lima ("BVL", otherwise known as the Lima Stock Exchange) under the symbol LPK, and in Germany on the Frankfurt Exchange ("FRA") under the symbol LQP.

Outlook

The Company's immediate priority is to obtain additional capital financing to sustain its administration and development activities, including the capital financing needed to commence commercial operations and generate cash flow from the Invicta Gold Project. With virtually all of the necessary permits and contractor and community agreements in hand, management is focused on obtaining the financing necessary to put the Invicta Gold Project into production as planned.

Additionally, the Company will continue to assess its mineral exploration and development opportunities for the Crucero Gold Project and the Josnitoro Gold Project, and conduct related activities as available cash resources allow.

Financial Highlights

All amounts are in Canadian Dollars unless otherwise stated.

Financial results for the six months ended June 30, 2015 and 2014 are summarized as follows:

| Six months ended June 30 ($000’s) | ||||

| 2015 | 2014 | |||

| Operating expenses | ||||

| Exploration | 1,804 | 1,584 | ||

| General and administration | 603 | 883 | ||

| Operating loss | 2,407 | 2,467 | ||

| (Gain) impairment loss on available-for-sale financial asset | - | 301 | ||

| Finance income - interest | (5) | (14) | ||

| Foreign exchange loss (gain) | 8 | (27) | ||

| Loss for the period | 2,410 | 2,727 | ||

| Loss per share - Basic and diluted | $0.03 | $0.03 | ||

Exploration expenses

Following is a summary of project expenditures for the six months ended June 30, 2015:

| In thousands of dollars | Crucero | Invicta | Josnitoro | Total | |

| Camp, community relations and related costs | 119 | 903 | - | 1,022 | |

| Project administration, concession fees and other | 286 | 368 | 128 | 782 | |

| 405 | 1,271 | 128 | 1,804 |

Exploration expenses relate to the Peru operations of the Company and totalled $1,804,000 for 2015, compared to $1,584,000 for 2014, a net increase of $220,000 for the period, which reflects: increased camp, community relations and related costs of $1,150,000 for 2015 compared to $976,000 for 2014, with the increase of $174,000 primarily being a result of an increase in Invicta pre-construction activities and Josnitoro community relations costs, offset by an aggregate decrease in Crucero exploration activities; increased project administration costs of $652,000 for 2015 compared to $555,000 for 2014, with the increase of $97,000 primarily being a result of an increase in Invicta pre-production expenditures incurred, offset by net decreases in severance of Crucero Gold Project employees and SBC costs; all offset by a decrease in technical reports, assays, and related costs to $Nil for 2015 compared to $51,000 for 2014, as no such costs were incurred.

General and administration expenses - all such expenses relate to the Canadian operations of Lupaka Gold and totalled $603,000 for 2015 compared to $883,000 for 2014, with the decrease of $280,000 being mainly the result of decreases in: shareholder and investor relations ("IR") expenses to $164,000 for 2015 compared to $280,000 for 2014, a decrease of $116,000, reflecting IR cost reductions relative to the first six months of 2014, when there was an investor relations program focused on the establishment of a European investor presence in the Company's shareholder base, and a decrease in IR staffing costs and other individually insignificant cost decreases totalling $8,000; professional and regulatory fees to $84,000 for 2015 compared to $136,000 for 2014, a decrease of $52,000 which reflects a reduction in corporate legal and Peru listing-related sponsorship fees, and a decrease in advisory, audit and legal and transfer agent costs; salaries and benefits totalled $276,000 for 2015 compared to $327,000, a decrease of $51,000, which reflects a $17,000 higher allocation of Canada senior management costs to Invicta for 2015 and reduced SBC expenses for 2015; and reduced office and general, and travel costs of $61,000 due to reduced office lease and corporate travel costs.

A snapshot of the Company's balance sheet is as follows:

Liquidity and Capital Resources

| In thousands of dollars | June 30, 2015 | December 31, 2014 | ||

| Cash and cash equivalents | 43 | 2,239 | ||

| Working capital (defined as current assets less current liabilities) | (1,088) | 1,242 | ||

| Total assets | 28,648 | 30,663 | ||

| Total liabilities | 1,640 | 1,539 | ||

| Shareholders’ equity | 27,009 | 29,124 |

The principal changes in the Company's cash during the six months ended June 30, 2015 were as follows:

- Cash used in operating activities in the six months ended June 30, 2015 was $2,196,000 ($2,723,000 - six months ended June 30, 2014), principally to fund the Company's loss for the period of $2,410,000 ($2,727,000 - six months ended June 30, 2014) which was offset by non-cash charges including depreciation of $58,000 ($86,000 - six months ended June 30, 2014) and share-based compensation of $57,000 ($122,000 - six months ended June 30, 2014), as well as a net increase of $134,000 in non-cash working capital (decrease of $501,000 - six months ended June 30, 2014). In the six months ended June 30, 2014, there was an impairment loss of $301,000 recorded on the Company's investment in Southern Legacy ($Nil - six months ended June 30, 2015).

- Net cash used in investing activities in the six months ended June 30, 2015 totalled $33,000, compared with net cash from investing activities of $250,000 in the six months ended June 30, 2014. The Company's purchases of equipment totalled $33,000 in the six months ended June 30, 2015 ($34,000 - six months ended June 30, 2014) and in the six three months of 2014, the Company sold equipment for net proceeds of $284,000 ($Nil - six months ended June 30, 2015).

Total current liabilities as at June 30, 2015 totalled $1,256,000 ($1,159,000 - December 31, 2014), comprised of accounts payable and accrued liabilities, mostly for community and Invicta project-related obligations, and $383,000 of provisions for reclamation ($380,000 - December 31, 2014), the difference being attributable to a change in foreign exchange rates in 2015.

At present, the Company's operations do not generate positive cash flows and its financial success is dependent on management's ability to discover economically viable mineral deposits. The mineral exploration and development processes can take many periods and is subject to factors that are beyond the Company's control.

In order to finance the Company's exploration programs and to cover administrative and overhead expenses, the Company has typically raised capital through equity financings. Many factors influence the Company's ability to raise funds, including the health of the resource market, the climate for mineral exploration investment, the Company's track record, and the experience and calibre of its management. Actual funding requirements may vary from those planned due to a number of factors, including the progress of exploration activities. Management believes it will be able to raise capital as required in the long term, but recognizes there will be risks involved that may be beyond its control.

The Company has implemented various cost-cutting measures, primarily in the areas of administration, investor relations, project development and camp and related areas for the Crucero and Josnitoro Gold Projects. Additionally, management continues to evaluate capital financing alternatives which are available to fund the estimated US$2 Million of remaining pre-production expenditures needed to put the Invicta Gold Project into production in 2015.

As at June 30, 2015, the Company's aggregate common share capital was $57,360,000 ($57,360,000 - December 31, 2014) representing 92,545,110 issued and outstanding common shares without par value (92,545,110 - December 31, 2014).

As at June 30, 2015, the Company has 8,372,500 share purchase warrants outstanding at an exercise price of $0.30 and expiring on August 7, 2017. During the six months ended June 30, 2015, 612,500 share purchase warrants at an exercise price of $1.87 expired on February 12, 2015.

As at June 30, 2015, the Company has 7,916,750 stock options outstanding at exercise prices of $0.13 to $3.22.

About the Company

Lupaka Gold is a Peru-focused gold explorer and developer with geographic diversification and balance through its interest in asset-based resource projects spread across three regions of Peru.

Lupaka Gold currently has three projects occupying different stages of exploration and development.

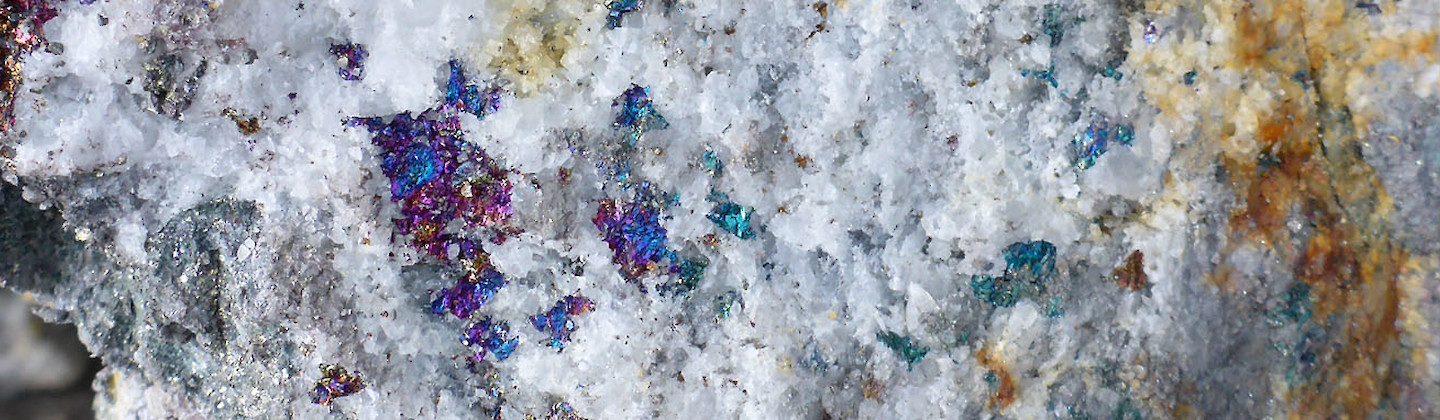

The Company's 100%-owned Invicta Gold Project (central Peru) has near-term underground gold and poly-metallic production potential. The Company plans to implement a small-scale mining operation and complete permitting, development and engineering with production to commence in 2015.

Lupaka Gold's flagship exploration project is the Crucero Gold Project, its 5,500 hectare gold property located in southern Peru. Crucero has a growing indicated and inferred gold resource, and the Company is actively exploring the property to identify future drill targets.

In November 2013, the Company optioned the Josnitoro Gold Project from Hochschild Mining PLC. The project is located approximately 600 kilometres by road southeast of Lima in the Department of Apurimac, southern Peru. Historical work on the disseminated gold zones includes over 170 shallow drill holes and extensive surface trenching.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.,

Investor Relations

+1 (604) 681-5900, e-mail: gold@lupakagold.com or visit the Company's website at www.lupakagold.com.

Forward Looking Information and Regulatory Endnotes

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). The forward-looking information contained in this news release is made as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Forward-looking information includes, but is not limited to, statements with respect to exploration plans and timing for Crucero, the grant of social license and exploration plans for Josnitoro, a potential mining operation at Invicta and estimates of mineral resources. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "projects", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved.

The forward-looking information contained in this news release is based on certain assumptions that the Company believes are reasonable, including with respect to mineral resource estimates, the key assumptions and parameters on which such estimates are based, that that the current price of and demand for gold will be sustained or will improve, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed on reasonable terms, that supplies, equipment, personnel, permits and local community approvals required to conduct the Company's planned exploration and development activities will be available on reasonable terms, that results of exploration activities will be consistent with management's expectations and that the Company will not experience any material accident, labour dispute, or failure of equipment. However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risk that actual results of exploration activities will be different than anticipated, that cost of labour, equipment or materials will increase more than expected, that the future price of gold will decline, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources are not as estimated, unexpected variations in mineral resources, grade or recovery rates, risk of accidents, labour disputes and other risks generally associated with mineral exploration and unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.

This announcement contains certain forward looking statements, including such statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In particular, such forward looking statements may relate to matters such as the business, strategy, investments, production, major projects and their contribution to expected production and other plans of the Company and its current goals, assumptions and expectations relating to its future financial condition, performance and results.

Forward-looking statements include, without limitation, statements typically containing words such as "intends", "expects", "anticipates", "targets", "plans", "estimates" and words of similar import. By their nature, forward looking statements involve risks and uncertainties because they relate to events and depend on circumstances that will or may occur in the future. Actual results, performance or achievements of the Company may be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Factors that could cause or contribute to differences between the actual results, performance or achievements of the Company and current expectations include, but are not limited to, legislative, fiscal and regulatory developments, competitive conditions, technological developments, exchange rate fluctuations and general economic conditions. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser.

The forward looking statements reflect knowledge and information available at the date of preparation of this announcement. Except as required by the Listing Rules and applicable law, the Company does not undertake any obligation to update or change any forward looking statements to reflect events occurring after the date of this announcement. Nothing in this announcement should be construed as a profit forecast.