VANCOUVER, BRITISH COLUMBIA, July 2, 2013 -- Lupaka Gold Corp. ("Lupaka Gold" or "the Company") (TSX:LPK, BVL:LPK, FRA:LQP) announces the results of its most recent campaign of metallurgical recovery testing on the mineralization from the A-1 Zone at the Company's Crucero Gold Project.

Summary results are from tests performed on two composite samples reflecting the two distinct mineralization types within the Crucero mineralization envelope. The wide range of recovery results reflects the suite of tests performed and the treatment options analyzed. Depending on types of minerals, their concentration and grind size, leach extraction of 60-75% gold was achieved. Diagnostic leach tests at ultrafine grinds showed leach extraction of 89% and 94% for the two composites. The results have not been optimized and were performed with the purpose of assisting the Company to focus its exploration efforts through improved understanding of mineral associations and minerology, as it explores the remaining 10 identified (to date) exploration anomalies at Crucero.

Eric Edwards, President and CEO of Lupaka Gold stated "We are satisfied that the testing has accomplished its objective and provided sufficient direction to the Company to proceed with additional exploration at Crucero. The gold bearing mineralization responds favourably to whole ore leaching, gravity, magnetic and flotation separation, and cyanidation final recovery of a doré product."

Working with Ausenco, the Company designed the test parameters for the most recent campaign to broadly evaluate the different mineralization types within the Crucero resource envelope. Mr. Edwards continued, "The metallurgical results obtained are within the range expected, but more importantly, show a path forward for optimization and further testing."

Summary Metallurgy Results For the A-1 Zone

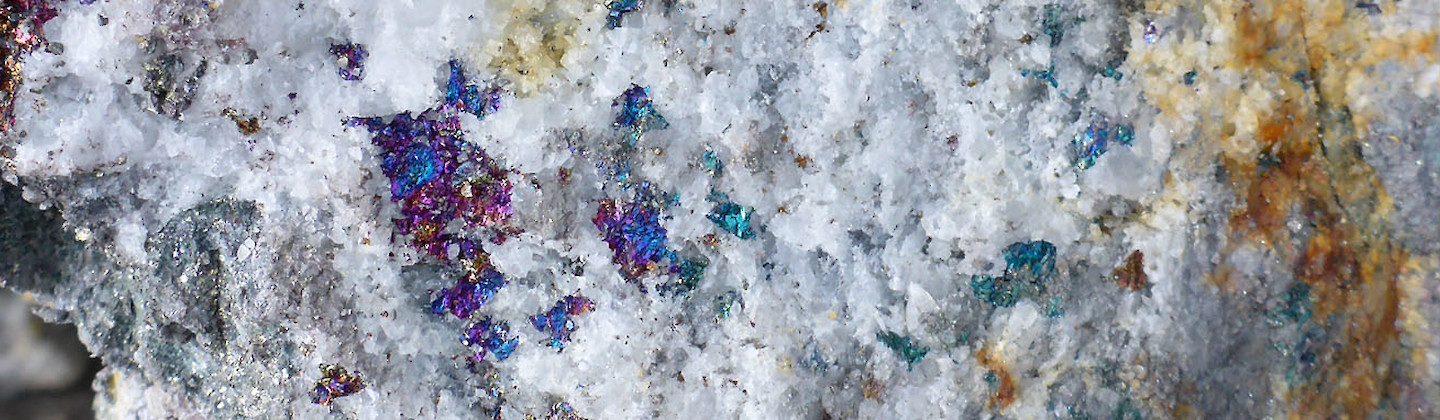

The metallurgical test work programme evaluating the characteristics of Crucero Gold Project's A-1 Zone was conducted by SGS Lima, Peru and managed by Ausenco. The focus of the test programme was to investigate the two major mineralization gold association types represented by two separate composites: a Northern, mainly pyrrhotite, composite; and a Southern, mainly arsenopyrite, composite.

The Ausenco work evaluated several different processing options including whole-ore leaching, pre-aeration, grind size sensitivity cyanide concentration sensitivity, flotation, flotation concentrate leaching at various cyanide concentrations and regrind sizes, flotation tailing leaching at various cyanide concentrations, gravity concentration which included flotation of gravity tails and leaching of gravity concentrate and gravity tails. Comminution testing included Bond Ball Mill Work Index and SAG Mill Comminution tests. As no variability testing was conducted, the results presented herein are considered preliminary and are to be further evaluated when future variability testing is conducted.

The comminution characteristics for the Crucero Gold Project's A-1 Zone indicate that the ore is medium hardness and has a high competency.

The test work demonstrated that the mineralization is mildly refractory to cyanide leaching. Leach times of 24 hours at a grind size of 80% passing 53 microns provided extractions of 60-65% for the Southern Composite having a 1.57 g/t gold head grade and 70-75% for the Northern Composite having a gold head grade of 1.24 g/t. Ultrafine grinding tests to 80% passing 10 microns on whole-of-ore samples increased extractions to 89% and 94% for the Southern and Northern composites respectively, indicating that extraction is likely to be a function of liberation and not necessarily true refractory (solid solution) losses. It should be noted that these extractions are considered preliminary as no variability tests have been carried out, and further gold association work is required prior to providing indications of extractions achievable over the whole deposit. Gold is considered to be the only mineral of economic interest.

The test work shows that the A-1 Zone gold extraction is independent of sodium cyanide concentration in the range 500 to 1500 mg/L. Opportunity remains to further reduce the cyanide dosing and concentration regime and thereby reduce operating costs. Pre aeration with air was found to provide sodium cyanide consumption reduction and further work in this area is warranted. Sodium cyanide consumption of nominally 2 kg/t was determined when sodium cyanide concentration of 500 mg/L was tested.

Conclusions and Recommendations from the test work

The test work completed to date has suggested metallurgical performance is likely associated with arsenic and pyrrhotite minerals, and potentially antimonial minerals, and is a function of grind size and mineral liberation. As the deportment and location of these minerals is not defined, there is a need to understand this aspect and also the associated metallurgical behaviour by variability testing.

Additional variability test work is required to define comminution and metallurgical parameters with ore types and mineralisation in the resource in addition to providing engineering data such as settling characteristics, viscosity, materials handling and rheology. Use of oxygen for pre aeration, review of lead nitrate addition, application of reduced cyanide concentration and gold deportment evaluations all provide opportunity to improve extraction efficiency and project economics.

About the Company

Lupaka Gold is a well-financed, Peru-focused gold explorer with geographic diversification and balance through its asset-based resource projects spread across northern, central and southern Peru.

Lupaka Gold's flagship project is the Crucero Gold Project, its 5,500 hectare gold property is located in the northern part of Puno, a southern region of Peru. The Company holds a 100% interest through Minera Pacacorral S.A.C. in the Crucero Gold Project, containing an indicated resource of 1,017,999 gold ounces at 1.01 g/t and an inferred resource of 1,190,526 gold ounces at 1.00 g/t. Since commencing active exploration in April 2010, the Company has reported annual NI 43-101 compliant gold resource estimate increases for the Crucero Gold Project from 2011 to 2013 (see the Company's most recent technical report on www.sedar.com).

As a result of the Company's recent acquisition of Andean American, Lupaka Gold's assets also include the 100% owned Invicta Gold Project in the central Lima region of Peru, which has near-term underground gold, silver and copper development potential. Lupaka Gold also owns a 17% stake in Southern Legacy Minerals Inc., owner of the AntaKori copper-gold deposit located in the northern Cajamarca region of Peru.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lupaka Gold Corp.

David Matousek

Investor Relations

+1 (604) 681-5900

or visit the Company's website at www.lupakagold.com

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable securities regulations in Canada and the United States (collectively, "forward-looking information"). The forward-looking information contained in this news release is made as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information. Forward-looking information includes, but is not limited to, statements with respect to mineral resource estimates, future upgrading of mineral resources, that the structural geological interpretation report will help create future exploration targets, and related outcomes. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects, "is expected", "budget", "scheduled", "estimates", forecasts", "intends", "anticipates", or "believes", or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved.

The forward-looking information contained in this news release is based on certain assumptions that the Company believes are reasonable, including, with respect to mineral resource estimates, the key assumptions and parameters on which such estimates are based, that the current price of and demand for gold will be sustained or will improve, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed on reasonable terms, that supplies, equipment, personnel, permits and local community approvals required to conduct the Company's planned exploration and development activities will be available on reasonable terms, that results of exploration activities will be consistent with management's expectations and that the Company will not experience any material accident, labour dispute, or failure of equipment.

However, forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risk that actual results of exploration activities will be different than anticipated, that cost of labour, equipment or materials will increase more than expected, that the future price of gold will decline, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources are not as estimated, unexpected variations in mineral resources, grade or recovery rates, risk of accidents, labour disputes and other risks generally associated with mineral exploration and unanticipated delays in obtaining or failure to obtain community, governmental or regulatory approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof.